capital gains tax budget news

How a capital gains tax raid could cost you 24300 Rishi Sunak is plotting a 14bn capital gains tax grab with the Budget just days away By Harry Brennan 3 Mar 2021 1148am Five taxes that could. The Finance Minister Nirmala Sitharaman announced the capping of the surcharge on the long term capital gains payable on capital assets at 15 percent.

Chapter 9 Tax Fairness And Effective Government Budget 2022

The capital gains tax-free allowance for the 2021-22 tax year is 12300 the same as it was in 2020-21.

. Revamp likely in next budget to boost revenues welfare spendingLong-term capital gains on equities held for over a year is taxed at 10. When looking at the last calendar months the receipts totalled 104bn. Once again no change to CGT rates was announced which actually came as no surprise.

Jay Inslees proposed budget had recommended a capital-gains tax with a 7 percent rate that would have raised about 800 million in the 2017 fiscal year. Earlier this week the president proposed a minimum 20 percent tax rate that would hit both the income and unrealized capital gains of US. Capital gains taxes on assets held for a.

The tax that is charged on long. It was then increased to 6667 per cent in 1988 and then to a high of 75 per cent in the 1990s. Mr Shah told Expresscouk that.

Two years of the Covid-19 pandemic has left the economy fragile. In 2000 it dropped twice first to 6667 per. If you buy a listed bond then you pay long-term capital gains LTCG tax of 10 percent if you hold it for more than 12 months.

Ad Read this guide to learn ways to avoid running out of money in retirement. But with tax collections looking up experts feel there is room for the government to make some concessions in favour of the taxpayer. Jay Inslee on Thursday unveiled a 2021-23 operating budget proposal that includes 576 billion in spending for state operations such as schools prisons and social services.

11 hours agoThe tax paid is known as capital gains tax and there are two types of capital gains short-term capital gains tax STCG and long-term capital gains tax LTCG. Going beyond Lawson to remove peculiarities such as death uplift whereby the tax is wiped. Households worth more than 100 million as part of his.

For the sale of a business such as a small advice firm sole traders or partnerships pay. AP Senate Democrats on Thursday released a 592 billion two-year budget plan that includes 357 million in new revenue from a tax on capital gains and laid out how they would separately spend more than 7 billion spending of federal stimulus funds meant to help those hit hardest by the coronavirus pandemic. But if you sell a debt mutual fund the threshold for paying capital.

For investors whose taxable income including the short-term realised gain is 75009 or more the taxation will be increased from the flat rate of 28 or 35 for investments held in blacklisted jurisdictions to progressive rates which can be as high as 48 or even 53 if your total income exceeds 250000. For 2021-22 youll be charged at 10 on the first 1m of gains when selling a qualifying business the same as the 2020-21 tax year. Inslee proposes big boost in state spending new taxes over next two years Austin Jenkins December 13 2018.

The tax is currently paid at a 40 percent rate on anything over 325000 this threshold will be frozen until 2026 as announced by Mr Sunak in the March Budget. The Center Square The Washington State Economic and Revenue Forecast Council ERFC adopted an official outlook based on the 2022 supplemental budget that continues to assume capital gains tax. Asset sales have increased by around 2 to 115 of the tax revenue over the last 12 months largely because of the nervousness that the Chancellor would bring CGT more in line with income tax but again this did not materialise.

The House proposal would also. At the time Neil Jones tax. Entrepreneurs relief was slashed last April so that instead of being charged 10 on the first 10m of gains anything above 1m would be taxed at the usual 20.

The CGT receipts were tallied at 76bn for the tax year to date April 2020 to January 2021. Washington House Democrats on Monday unveiled a proposed 14 billion tax package including a new capital gains tax to fund a two-year budget with Government and Politics Gov. House Democrats on Monday proposed raising the top tax rate on capital gains and qualified dividends to 288 one of several tax reforms aimed at wealthy Americans to help fund a 35 trillion.

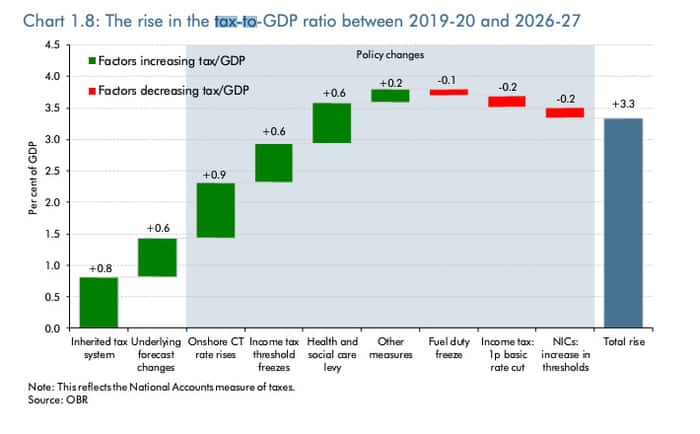

If you have a 500000 portfolio get this must-read guide by Fisher Investments. In 2019-20 the static tax revenue raised from taxing capital gains like income would be almost 16bn. About 14bn could be raised by cutting exemptions and doubling rates according to the.

This is expected to benefit. Tax pitfalls while selling assets buying a house. In 2021 and 2022 the capital gains tax rate is 0 15 or 20 on most assets held for longer than a year.

The amount of tax levied on capital gains could be raised by billions of pounds according to a new report. One of these is the need to relook at how long-term capital gains tax can be minimised.

Spring Statement 2022 Living Standards Set For Historic Fall Says Obr After Sunak Mini Budget As It Happened Politics The Guardian

Reap The Benefits Of Tax Loss Harvesting To Lower Your Tax Bill Investing Income Tax Preparation Capital Gains Tax

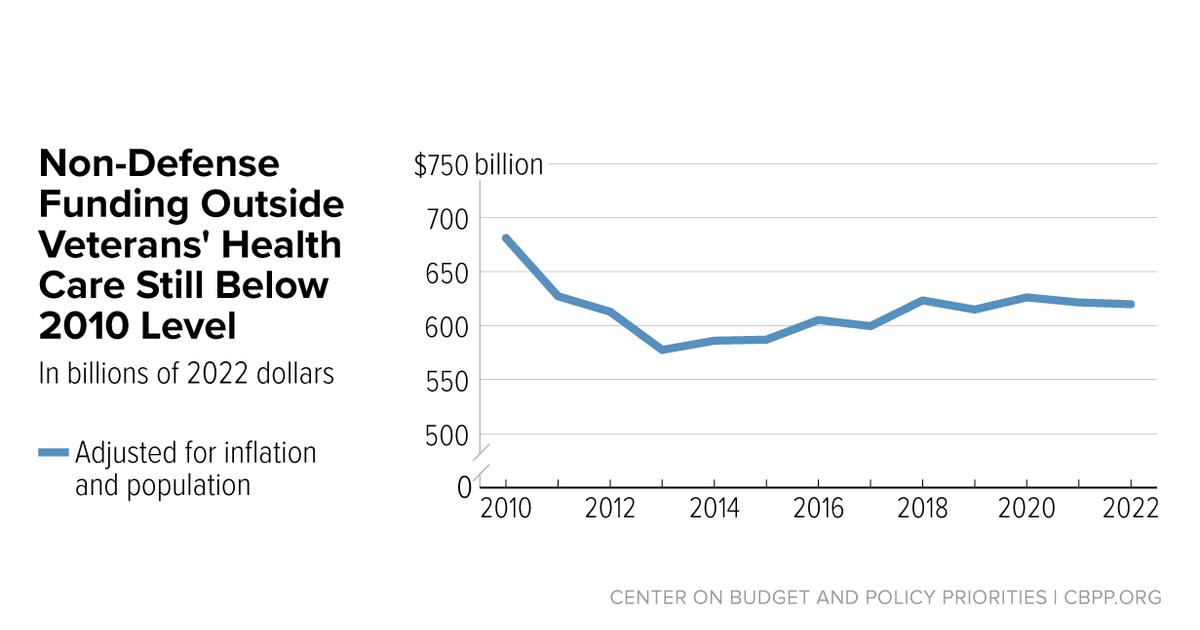

Analysis Of President Biden S 2023 Budget Center On Budget And Policy Priorities

Biden S Better Plan To Tax The Rich Wsj

Capital Gains Taxation And Deferral Revenue Potential Of Reform Penn Wharton Budget Model

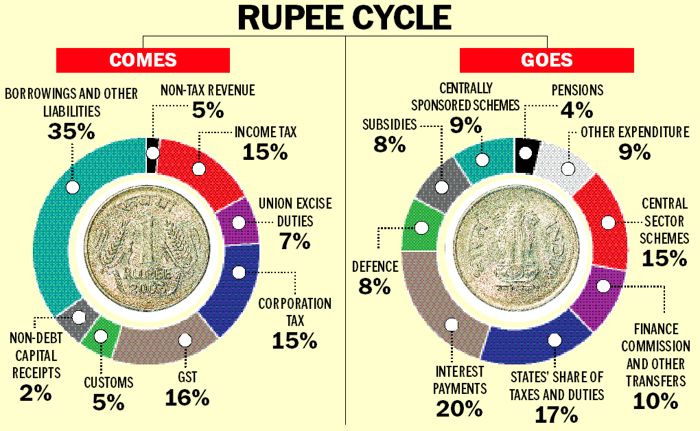

Union Budget 2022 23 Capex Push

Live This Budget Brings More Infra More Growth And More Jobs Says Pm Business Standard News

Biden Will Seek Tax Increase On Rich To Fund Child Care And Education The New York Times

Biden Tax How Would Biden S Billionaire Minimum Income Tax Work Cbs News

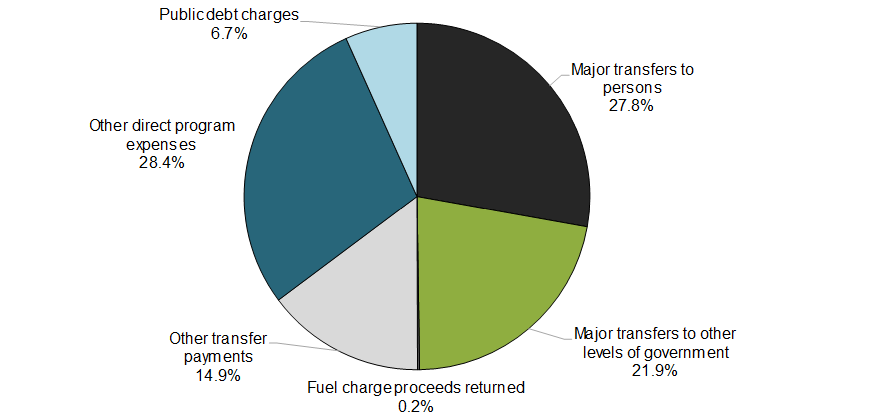

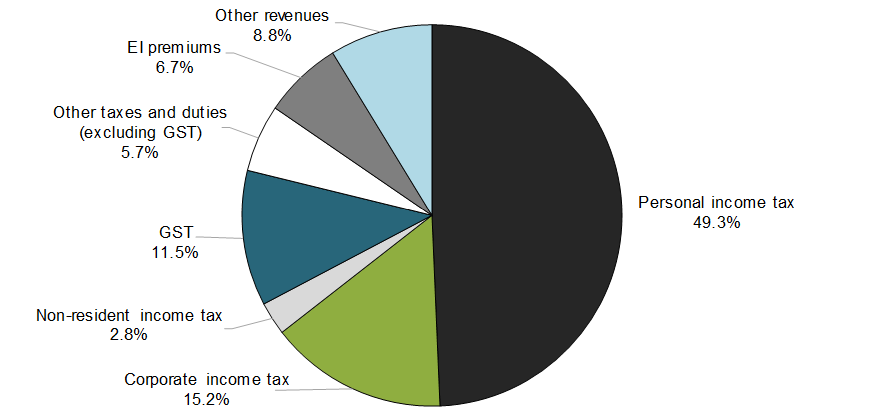

Annual Financial Report Of The Government Of Canada Fiscal Year 2018 2019 Canada Ca

Canadian Federal Budget 2022 Kpmg Canada

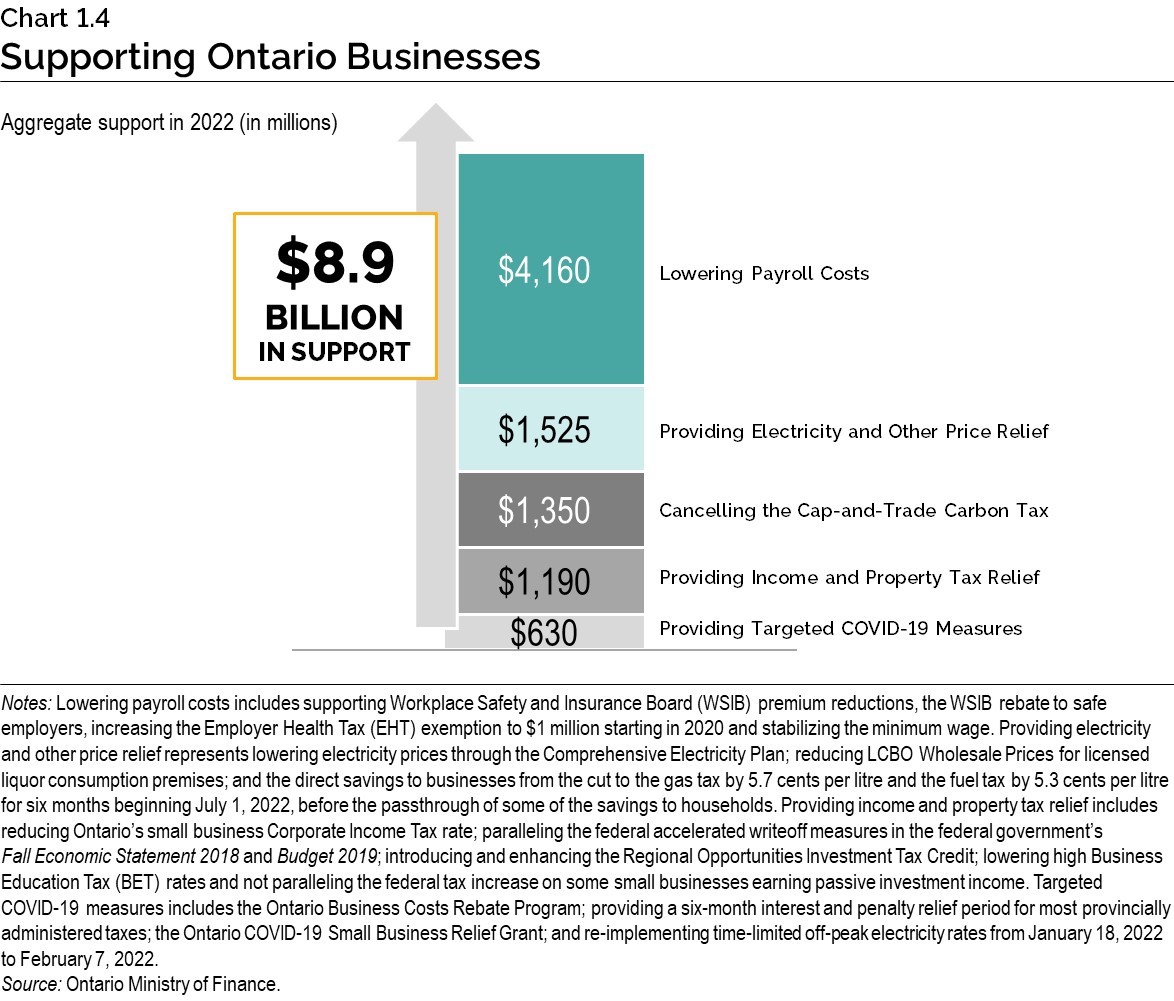

2022 Ontario Budget Chapter 1a

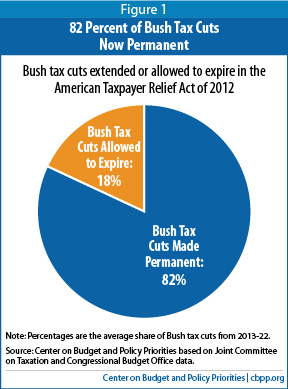

Budget Deal Makes Permanent 82 Percent Of President Bush S Tax Cuts Center On Budget And Policy Priorities

Annual Financial Report Of The Government Of Canada Fiscal Year 2018 2019 Canada Ca

Chapter 9 Tax Fairness And Effective Government Budget 2022

What Is Short Term Capital Gains Tax Stcg Tax Budget News Short Term Capital Gains Tax Definition

There S A Growing Interest In Wealth Taxes On The Super Rich